Many of the investors in our community have expressed interest in learning more about the business of Commercial Real Estate Investing so they’re better informed on their investment decision making. We’re starting a new series called “The Harbor Drive Investor” to help educate our investors about our daily activities in the world of Real Estate Investing! Our goal is to bring you value and provide you with tools to help you achieve your Real Estate Investing Goals!

What is a Cap Rate?

The first topic we’ll cover is focused on the Capitalization Rate (aka ‘CAP rate’). This is a term we use in our real estate incvesting business on a daily basis. A CAP rate is a popular tool used to measure a real estate investment’s profitability and percentage rate of return, assuming we purchase the investment on an all-cash-basis (no debt or loans). CAP rates are used across all commercial real estate investment classes including multifamily (apartment buildings), office, retail, industrial, self-storage, mobile home parks commercial agriculture and flex commercial. CAP rates can vary from city to city based on a variety of reasons including the neighborhood the asset is located in, the age of a given property, interest rates (set by the Federal Reserve), lending volatility, asset class, asset grade (A, B, C, or D), investor competition in a given market, implied risk of an investment, etc. CAP rates in a given market are always in fluctuation based on many of the reasons in the previous sentence.

How Do I Calculate the Cap Rate?

It’s important for real estate investors to understand how the CAP rate is calculated. Below are the two factors used to calculate a CAP rate:

Net Operating Income (NOI): NOI is the sum of all your property’s collected income over the previous 12 month period, minus all your property’s operating expenses over the previous 12 month period

Purchase Price: The purchase price of a particular investment property

If we are looking at an apartment investment and the trailing 12 month actual NOI (total income minus total expenses) was $100,000, and we have the opportunity to purchase this investment for a price of $1 million, then our CAP rate would be 10% (NOI divided by Purchase Price equals CAP Rate). The equation would look like this:

By the way, a 10% CAP rate in today’s market and phase of the real estate cycle would be like finding a golden unicorn drinking from a candy-cane waterfall (that’s a great CAP)! We’re not saying you can’t find a 10% CAP rate investment out there, but they are few and far between in today’s phase of the real estate cycle. To put it in other words, the lower the CAP rates are in a given market, the higher the purchase price. Also, the lower the CAP rate, the lower the cash-flow an investor can expect assuming the property operates in the same manner as the historic financial statements imply.

The Best Part!

At Harbor Drive Holdings, we use strategies to increase the value of a real estate investment property by increasing the NOI assuming the CAP rates remain the same in a given market. For example, if we acquire a property with $100,000 NOI, and we implement some type of value proposition (raise below market rents, reduce higher expenses, fix some kind of functional obsolescence, bring down units to rent-ready condition, etc.), and are able to increase a property’s NOI, we are not only increasing investor’s cash-flow, but we are simultaneously increasing the property’s value (appreciation).

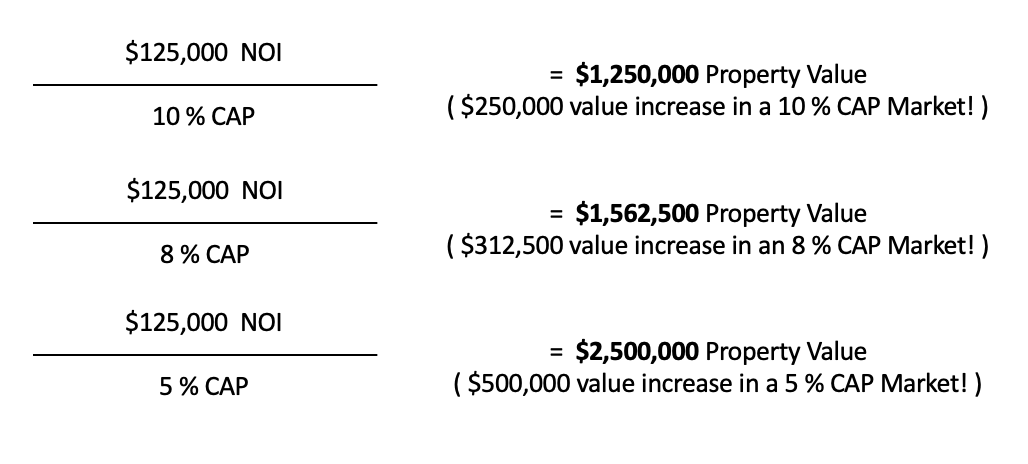

Below are similar examples to the examples above, except now we’re using market CAP rates, divided by our new NOI (assuming we can increase NOI by $25,000 over an investment period) to see our new property value. Watch what happens to our appreciation!

As mentioned earlier, CAP rates can vary from market to market based on a variety of reasons discussed. As many of you know, Harbor Drive Holdings seeks well located real estate investment properties, with some form of ‘Value-Add’ proposition whereby we can increase the investment’s NOI, and therefore increase its value, all while providing strong cash-flow to our investing partners!

If you would like to learn more about CAP rates or you’re interested in participating in one of our upcoming investment offerings, we’d love to connect with you! Our contact information can be found below and we encourage all investors to reach out to us with any questions or simply to say ‘hi’ and re-connect!

Until next time…..

Happy Investing!